Setting the Pace in Auto: Thinking Bigger than Tariffs

UAW members and allies rallied outside of Troy, Michigan, in 2023 at the headquarters of VU Manufacturing after the company laid off and blacklisted 400 auto parts workers in Mexico who made arm rests for various auto brands. The repression came after the Mexican workers unionized with an independent union. Photo: Jim West/jimwestphoto.com

President Donald Trump’s infatuation with tariffs dates back to the 1980s, when he first said tariff was “the most beautiful word in the dictionary.” On March 26 he announced “a 25 percent tariff on all cars not made in the U.S.,” but exempted auto parts that comply with the U.S.-Mexico-Canada Agreement, the successor to NAFTA.

For those parts, and for the 25 percent of U.S.-sold vehicles that are assembled in Mexico and Canada, the tariffs will be applied partially at an undisclosed date to only the non-U.S. part of the vehicle’s value. Essentially, auto manufacturing is already so integrated across North America that the administration has left carve-outs for Mexico and Canada.

The president’s approach to the auto industry offers an opportunity to clarify the goals of U.S. trade policy. To understand what is really in the interests of working people, we have to separate the president’s political whims from the changing contours of global capitalism.

For politicians and auto executives, at stake is whether the U.S. auto industry will be an appendage of a global market, or a North American continental market, or a national market. Their aim, as always, is the most profit possible, and they are indifferent to national boundaries.

But for the 12 million workers in U.S. manufacturing, the question is whether it is possible, under this administration and in this moment of twenty-first-century capitalism, to create a pro-worker, pro-union trade policy.

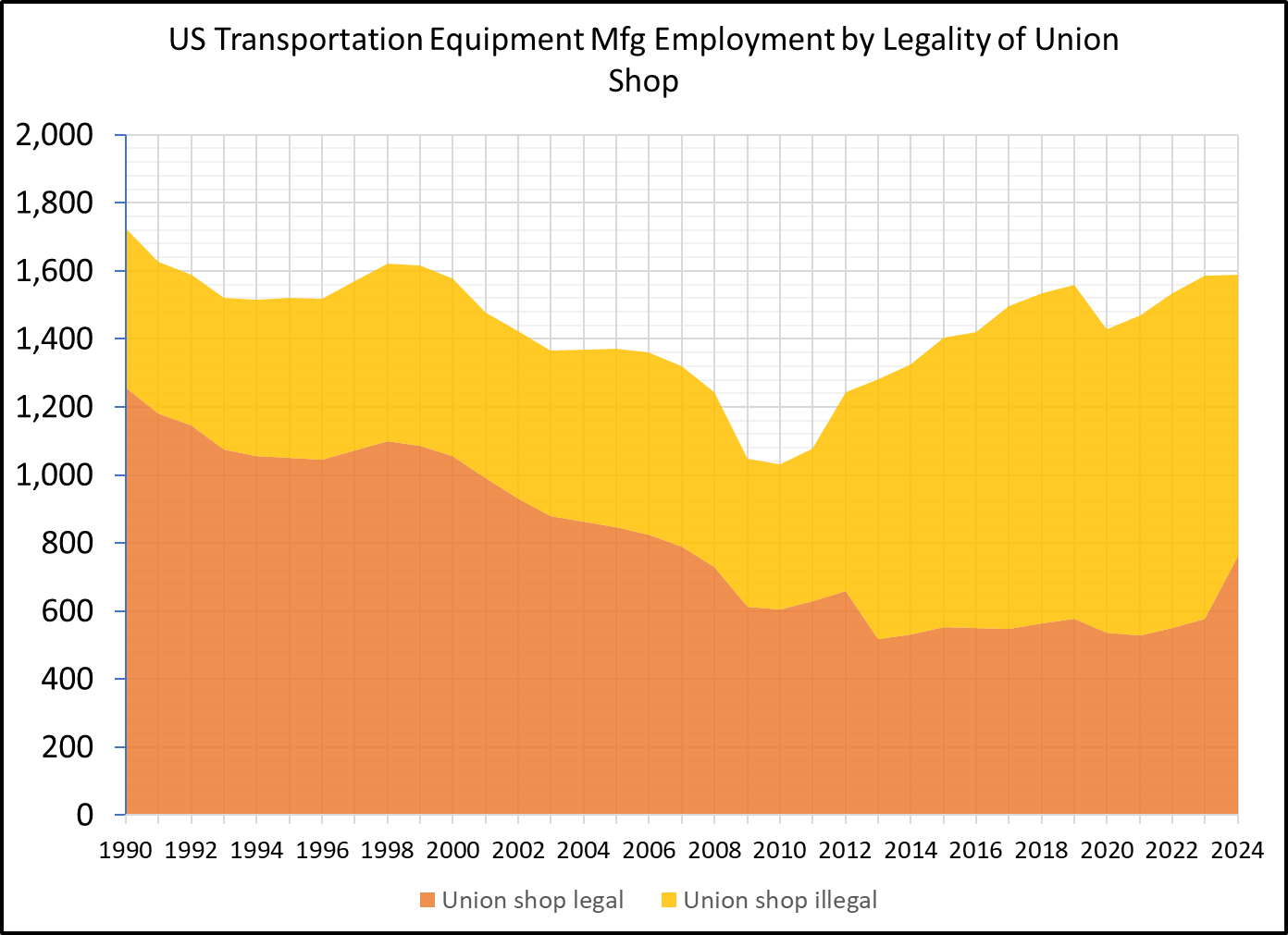

The Trump administration’s focus on tariffs obscures the nature of this problem. Despite the accumulated traumas of waves of partial restructuring, the U.S. auto industry has spent most of the last 16 years growing. When jobs last peaked, in spring 2023, there were more than 1 million workers producing motor vehicles and their parts inside the nation’s borders. Yet most of this growth is in nonunion jobs.

In 2023, for the first time in history, nonunion auto companies out-produced the Big 3 in U.S. assembly, 4.9 million vehicles to 4.6 million.

Whether Trump’s tariffs game will lead to a further growth of jobs ultimately depends on the level of demand in the economy—on whether people are buying cars. But it’s not difficult to understand why his call for change has been received with enthusiasm among many auto workers.

For 45 years, the automakers have used the threat of relocating to compete on wages and on tax breaks. The multinational corporations that control the industry increase, reduce, or eliminate production across their networks of suppliers and assembly plants based on lower costs and their political power over governments.

It is this power of the corporations to locate where they will that has led the United Auto Workers to embrace Trump’s tariffs. But it has been the competition between the union and nonunion parts of the industry, under managerial prerogatives, that has ingrained fear in the workforce and allowed the employers to set the pace.

Of the 14 U.S. assembly plants the industry opened between the passage of NAFTA in 1994 and the financial crisis of 2007-2009, 10 were in right-to-work states and one was in Indiana, which became right-to-work in 2012. Three were in the union part of the industry.

TRADE RESTRICTION LIKE IT’S THE ’80S

The growth of nonunion auto in the U.S. during the 1980s was driven by trade restrictions: deliberate government interference with “free trade.”

Unable to sell into the U.S. market under Ronald Reagan’s import quotas on Japan, five Japanese automakers (Honda, Nissan, Toyota, Mitsubishi, and Subaru) opened plants in the U.S. between 1982 and 1989, all nonunion. Before Reagan, 75 percent of vehicles sold here were assembled with union labor (the other 25 percent were imported). Ten years later, the union share was down to 60.

This competition from foreign-owned “transplants,” combined with a recession from 1979 to 1982 stretching across three model years, forced profound changes in U.S. vehicle production. With consumers’ pocketbooks hurting and fuel costs rising, the transplants had an edge because they were building smaller vehicles—and because they were nonunion, with lower labor costs.

But most of all, the competition played out so destructively for workers because the U.S. new vehicle market was, and continues to be, saturated. The industry suffers from overcapacity: the auto brands are capable of producing more vehicles than they could ever sell. Overcapacity drives them to stiff competition, to search for lower costs any way possible.

The transplants are mainly in the South and their pay and benefits were significantly lower than in UAW plants until 2009. State governments offer their owners huge tax breaks as enticements, forcing local communities to sacrifice funding for K-12 education, parks, and libraries.

It is the price competition between the union and nonunion companies that drove the industry’s growth in low-wage but highly skilled workers in Mexico.

CONTINENTAL INDUSTRY

This is the pattern of competition—between the Big 3 and the transplants for a saturated market—that has driven the employers as a group to transform auto manufacturing into a continental industry. Production is integrated across national borders today, with 43 percent of all North American auto employment now in Mexico.

Understanding how trade policy has created this continental industry is important for workers seeking to understand how trade rules might be used to their advantage.

WHY THE BIG 3 WANTED NAFTA

NAFTA changed laws inside both Mexico and the U.S. Before, the U.S. would charge a tariff on all the "value added" on products shipped abroad for processing and imported back into the country. This meant the maquiladoras (foreign-owned factories in Mexico) could not source materials from inside Mexico. NAFTA changed this, so the maquiladora plants became "full package" companies—more independent. Much of the auto parts industry migrated to Mexico.

Meanwhile, once Japanese-owned companies began building assembly plants in the U.S., Japanese-owned parts suppliers here also grew; their number quadrupled from less than 50 to more than 200 during the late 1980s.

Managers at the Big 3, having lost around 4 million vehicles in annual sales to foreign-designed models, sought to close assembly plants and adopt “lean” Japanese methods of supply-chain management. Between 1979 and 1991, the Big 3 reduced their number of assembly plants by 12, from 69 to 57, representing one-third of their capacity.

But the deepest effect of transplant competition—the U.S. firms’ motivation for pushing NAFTA—was in the parts industry. More than 1,000 different parts plants would supply the typical assembly plant during the 1970s; by the 1990s the number was 700 or 800 per plant.

The goal was to get a larger volume of product from a smaller number of assembly plants with fewer suppliers. In short: the entire industry was sped up. The suppliers, as well as the in-house parts divisions of both General Motors and Ford, all set up shop in Mexico.

FROM NAFTA TO BANKRUPTCY

For much of the twentieth century, the Mexican government—like the rest of Latin America—limited foreign ownership and investment in businesses within its territory. The pattern of foreign companies siphoning profits to New York and London motivated these countries to grow their own capitalists through trade protection to keep profits at home.

The introduction of transplants north of the border began to change all this. And the collapse of oil prices during the 1980s caused the Mexican government to look for other sources of revenue.

The de la Madrid and Salinas administrations found eager allies in the Big 3, reeling from their competition with the transplants. GM opened its first maquiladoras in 1978, and in 10 years contracted with 15 companies operating 27 plants employing 20,000 Mexican workers. Under the terms of U.S. trade law at the time, GM only paid customs duties on the “value added” in Mexico—the company shipped components from the U.S., assembled them into instrument panels, air and heating controls, lights, seats, etc., and paid tax on the price difference, which was only the meager wages paid in Mexico.

SUPPORT LABOR NOTES

BECOME A MONTHLY DONOR

Give $10 a month or more and get our "Fight the Boss, Build the Union" T-shirt.

By 1992, as Mexico loosened its investment laws, GM’s maquiladora footprint had grown to 32 export plants employing 30,000 workers. This was in addition to another 55,000 in domestic assembly plants for the Mexican market—making GM the largest employer in Mexico. Chrysler and Ford had 21,500 and 31,500 employees in the country.

While you might think the Big 3 wanted NAFTA in order to begin moving to Mexico, in reality what they wanted was to stabilize competition in the U.S. NAFTA provided protection for the incumbent automakers on the North American continent who owned existing Mexican factories.

The only auto companies with factories in Mexico in 1994 were Chrysler, Ford, GM, Nissan, and VW. These companies were exempt from Mexico’s 30 percent content requirement; any other corporations that wanted to open factories in Mexico were not. And in order to qualify for duty-free trade, the industry was required to source 62.5 percent of parts from the North American continent by 2002.This gave companies like Honda and Toyota seven years to either start buying from the North American suppliers or bring their own parts companies to open new factories on the continent—where Mexico was the growing geography for parts makers.

In those seven years, the U.S. Big 3 stabilized their market share of U.S. sales for the last time. Earlier, the transplants had concentrated on smaller cars. In 1999, Toyota began production of the first Tundra full-size pickup truck—competing with the Big 3 on territory they had seen as their own. All the growth in pickup sales till 2004 was accounted for by new transplant trucks.

At the same time, NAFTA accelerated the restructuring of the parts industry that had begun in the 1980s. GM and Ford, which had already consolidated their parts subsidiaries, both spun them off in 1999, creating Delphi and Visteon. By 2005, when Delphi declared bankruptcy, the company employed just 33,000 in the U.S, down from 190,000 in 2001. The transplants opened 11 more plants while employment at the Big 3 fell from 600,000 in 1990 to 300,000 in 2006. With the bankruptcies of GM and Chrysler during the financial crisis three years later, the Big 3 downsized from 250,000 to 170,000 jobs (salary and hourly) in two years.

NEW TRADE PACT

Across liberal and conservative administrations, the U.S. has been trying to “manage” trade for decades. Republican George H.W. Bush designed NAFTA and Democrat Bill Clinton championed it and signed it. But the underlying problems of excess capacity and fierce competition didn’t diminish. If anything, NAFTA and the neoliberal capitalist regime turbocharged the overcapacity problem. These are questions of managements' rights in shaping the industry, which the UAW had challenged in collective bargaining most aggressively before the Cold War. Having retreated from challenging the priority of profits and giving workers a say in investment and pricing decisions, the union was left with the politics of tariffs.

The negotiation and passage of the USMCA, NAFTA’s replacement, in January 2020 marked the beginning of the current phase of auto politics.

The USMCA strengthened NAFTA’s continental protectionism, but now against China rather than Japan and Europe. It established a continental auto minimum wage of $16 per hour, raised “regional value content”—the North American content the vehicle must have in order to qualify for duty-free trade—from 62.5 percent to 70 percent, and prohibited members from entering into trade agreements with “non-market” nations, meaning China.

This was because management had given a growing role to Chinese factories in supplying the Mexican market. Though Mexico assembled over 3.9 million vehicles last year, just 500,000 of them were sold within the country.

GM’s global structure shows how this works. Of 889,000 light vehicles GM assembled in Mexico in 2024, 831,000 were for export—717,000 to the U.S., 95,000 to Canada, and the remainder to Latin America, the Caribbean, and the Middle East.

At the same time, GM sold 205,000 cars in Mexico that year. Joint ventures like GM-SAIC in China meet this demand; of GM’s 175,000 imports to Mexico, 132,000 were from China.

The USCMA’s most innovative departure from NAFTA is its “Rapid Response Mechanism” (RRM) for labor disputes. This is a committee of representatives of the three nations empowered to hear complaints about labor-law violations at individual establishments and submit cases to the respective national governments for enforcement.

Though only the nations can bring complaints, and those complaints must address violations of labor law in the countries where they occur, the recent strengthening of collective bargaining rights in Mexico—requiring member votes on union contracts and secret-ballot elections for union leaders—has enabled workers in that country to use the RRM successfully to build power in two dozen facilities.

Because the text of the RRM annex includes a broad carveout for the U.S, U.S. workers have not been able to use the Rapid Response mechanism.

WHAT MIGHT TARIFFS DO FOR U.S. WORKERS?

Trump’s project of creating a domestic market with domestic jobs through tariffs alone will not solve the Big 3’s problem of competition from nonunion firms, nor eliminate management’s prerogative to exploit nonunion labor to compete for sales. Whether sales will grow will depend in part on what the government does—and Trump seems willing to head the country into a recession.

Neither is it likely that tariffs will open production and plant-location decisions to participation by the UAW, at least without a massive campaign to organize nonunion auto workers. Reducing employers’ ability to discipline the union by moving production around is a worthy goal. But tariffs will only alter one element of this calculus—leaving out of the equation the equally important need for a healthy, high-demand economy.

Furthermore, if Trump’s current National Labor Relations Board has a say, large-scale organizing will be unlikely to succeed. His nominee for NLRB General Counsel is a management-side labor lawyer from Morgan Lewis, the law firm representing SpaceX, Tesla, Apple, and Amazon in their suits against the constitutionality of the NLRA. Trump has made clear his hostility to unions, ending collective bargaining rights for 700,000 federal employees with a stroke of his kingly pen.

Wresting control of the industry from this alliance of top corporate management and anti-union politicians would require a militant movement, armed with political education, pressing the case for seizing control of the industry on the question of management rights. It would have to be based on a labor culture of confidence, rather than the fear that drives protectionism. It would need to raise aspirations: that labor should control, not merely limit, the plans of corporate employers.

Such confidence is difficult these days. But before Trump was elected, the UAW had begun taking steps toward building this culture.

CONTROLLING THE INDUSTRY REQUIRES MORE THAN TARIFFS

Empowering an independent RRM, capable of receiving complaints from workers themselves, and most importantly settling disputes on a scale larger than a single establishments, would be a way of using trade negotiations to strengthen workers’ power: a continental labor board on the side of workers.

Before the Cold War, the U.S. labor movement long aspired to control trades and industries on international lines. Achieving this on the North American continent would require the growth of militant unions in Mexico interested in coordinating bargaining demands with workers in the U.S. A continental labor board could provide a framework for shared bargaining rights that would make such coordination possible.

Including tariffs in a program to grow the U.S. auto industry is possible to imagine: Determine the price increase that would be necessary to make it profitable for U.S. producers to produce domestically, and adjust the section of the tariff code accordingly. The U.S., after all, has had one of the lowest barriers to auto imports of the developed world for three decades: the European Union charges 10 percent; during the 2000s, China imposed duties of 14 to 28 percent. Even President Obama imposed a three-year tariff increase on Chinese tires from 2009 to 2012.

But where such ambitious economic planning has been undertaken, tariffs have been just one component of the larger program of controlling the corporations. Tariffs did not work by themselves. Countries as different as Brazil and China built up their auto industries by requiring domestic content for assembly, just as NAFTA and USMCA require continental content. Brazil created an auto industry in 20 years by limiting imports through tariffs and then regulating the hell out of the corporations with taxes and domestic-content requirements.

In the U.S., the most obvious way of forcing the industry to grow would be lowering its prices and limiting its profits. Banning stock buybacks, taxing excess profits, and raising individual income taxes on senior managers would force corporations to reinvest their earnings, since they couldn’t pay them out any other way. This creates jobs. Another possible policy would be to institute U.S. content requirements. And the classically New Deal approach of helping the union to set the industry’s wage floor is the obvious starting point of pro-worker economic planning.

Such a vision for the industry is far from Trump’s mix of anti-union open shop, economic nationalism, and ugly anti-Mexican rhetoric.

When the federal government stepped in to the Chrysler and GM bankruptcies in 2009, it did the opposite of using government power to impose more pro-worker controls. Instead it gave the companies free rein to slash jobs and cut wages for new hires in half—under the assumption that restoring profits was the main goal. That was followed up by legislatures in the heart of the old auto country passing right-to-work laws—Indiana (2012), Michigan (2013), Wisconsin (2015), and Kentucky (2017).

This alliance reveals ruling-class assumptions about how the auto industry must be run—maximum profits above all else, with weak and non-existent unions. Tariff protection promises to raise costs but says nothing about prices. This is good for U.S. workers, who are those costs. But for workers across the continent, anti-union managers will be emboldened if sales continue to slump.

Going further and changing those assumptions must be at the heart of any project to reorganize the industry. As the recession approaches, this should be top of mind for auto workers.

Andrew Yamakawa Elrod is a historian who studies wage and price controls in the United States..

![Eight people hold printed signs, many in the yellow/purple SEIU style: "AB 715 = genocide censorship." "Fight back my ass!" "Opposed AB 715: CFA, CFT, ACLU, CTA, CNA... [but not] SEIU." "SEIU CA: Selective + politically safe. Fight back!" "You can't be neutral on a moving train." "When we fight we win! When we're neutral we lose!" Big white signs with black & red letters: "AB 715 censors education on Palestine." "What's next? Censoring education on: Slavery, Queer/Ethnic Studies, Japanese Internment?"](https://labornotes.org/sites/default/files/styles/related_crop/public/main/blogposts/image%20%2818%29.png?itok=rd_RfGjf)