Big 3 Focus on Auto Parts Centers in Strike Prep

Auto Workers Local 509 members at Ford HVC parts distribution center in Rancho Cucamonga, California, conducted a practice picket. Parts distribution centers have fewer workers than manufacturing facilities, but are often near urban areas, so if they go on strike, community support on the picket line could make a difference. Photo: UAW Local 509.

The automakers General Motors, Ford, and Stellantis are hurtling towards a showdown with United Auto Workers (UAW) as contract talks approach the September 14 strike deadline.

As the Big 3 automakers scramble to make contingency plans, they are shining a spotlight on one specific part of the supply chain: the parts distribution centers that supply after-sales spare parts and accessories to dealerships.

In August, reports leaked that Ford was preparing to deploy 1,200 non-union salaried employees to parts distribution centers (PDCs), or as Ford calls them, “high velocity centers.”

The plan proved to be controversial. Some salaried employees raised concerns about safety—a non-union employee got into an accident during the 2021 John Deere strike. They also expressed a desire not to scab on fellow workers.

Meanwhile Stellantis has been making its own preparations to weather a strike by stockpiling parts at a facility in Belvidere, Illinois, near its recently shuttered Belvidere Assembly Plant.

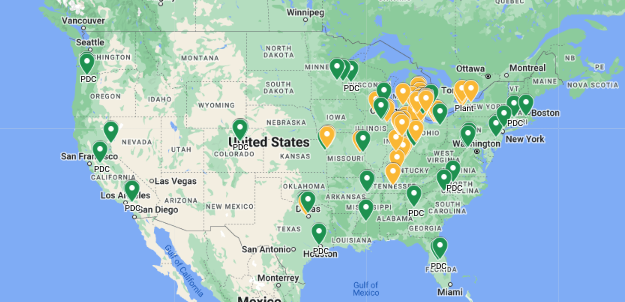

The Big 3 operate about 60 after-sales parts distribution centers across 25 states. There are likely 10,000 workers across these centers, which are more geographically dispersed than the 75 manufacturing plants concentrated in the Midwest, as shown on this map of Big 3 worksites.

STOCKPILING PARTS

Say you get into an accident, and you need a brand-new door. Or maybe it’s time to upgrade the

Some of these parts are manufactured at a Big 3 plant, while others are purchased from suppliers. But whatever the manufacturing source, if it is processed through a Big 3 distribution center, the results are the same: high profits.

Matt Frantzen, president of UAW Local 1268, which represented Belvidere Assembly workers, has been sending out emails to his members since he learned about stockpiling at the neighboring warehouse. Members are angry because the plant has been idled without product since February, with devastating consequences for the community. The closure has been a flashpoint in negotiations.

“They’ve increased the number of security cameras outside of the facility recently,” said Frantzen. “I wave at the cameras when I go by. Security sits outside the building in a Jeep Grand Cherokee.”

At the low-slung building a security guard parks the Cherokee diagonally across the parking lot entrance and chases away reporters like Labor Notes’ Luis Feliz Leon, who visited the plant in August. Why was the parking lot filled with workers’ cars if the plant was indefinitely shuttered? “It’s none of your business,” the security guard said.

In reality, the company has been staffing the warehouse with newly hired non-union workers—which Stellantis is trying to keep secret because there are 1,300 laid-off UAW members from the assembly plant who still live in the area.

“This is bargaining unit work and we should have been offered it,” Frantzen said. These new workers report that they are handling the same parts that would normally be handled by PDCs, and have confirmed this by a comparison of parts labels.

Linda Montes, a laid-off Belvidere worker, says they were told the facility was being dismantled. (It was formerly owned by a supplier, Yanfeng.)

"We don't believe it's true,” said Montes. “There are still semis coming in and out. There are no industrial dumpsters on site. One would think that there would be dumpsters if they were dismantling the place. Now there are security cameras up and ‘no trespassing’ signs up.”

MONEYMAKERS

All this raises the question, why are the Big 3 going to such lengths to keep after-sales parts flowing to customers?

Parts distribution centers come at the end of the supply chain, serving as warehouses for spare parts and automotive accessories in the after-sales market. Workers at PDCs unload the parts, store them, pick them, and get them ready for sale at dealerships. (For the most part, the dealerships themselves are not owned by the Big 3, and with some exceptions, workers at dealerships are not UAW members.)

PDCs are widely regarded as cash cows for the Big 3. Based on the volume of parts handled, the mark-ups, and the relatively low labor and research and development costs per unit, a larger processing facility can generate more than $1 million in profit every day for an automaker.

Even before dealerships apply markups, the Big 3’s own markups on after-sales parts are notoriously high. For instance, the manufacturer’s suggested retail price (MSRP) for the upper fascia (a component often made of plastic) covering a front bumper for a 2020 Chevrolet Equinox is $532.82.

EXPLOSIVE GROWTH

The demand for after-sales parts has been growing by double digits since the pandemic, as car owners focused on maintaining their aging vehicles due to inventory shortages of new vehicles. It has been a big business for GM, which has invested $168.5 million in building and modernizing another parts processing center in Michigan.

Well before Covid, however, parts and accessories had already been identified as a significant and growing source of profit for each of the Big 3 companies. Then-President Dan Ammann of GM said in 2017 that the company’s after-sales business generated billions of dollars of revenue and was a “huge profit-driver.” In 2015, Ammann said that after-sales profit margins were between 30 and 40 percent.

If parts distribution center workers walk out, it will have an immediate impact on profits and the ability of the Big 3 to serve customers. Dealerships usually have only limited inventories of parts, particularly bulky ones. During the 2019 GM strike, delays in obtaining spare parts led to customer dissatisfaction and a mad scramble by GM to fill orders as soon as the strike ended.

Bill Bagwell of UAW Local 174 works as an inspector at the GM Ypsilanti Processing Center. He recalls that in 2019, GM brought in as many members of management as it could to run his facility—but the company still ended up deep in the hole. When the strike ended, the national agreement permitted GM to run the facility on “critical status,” which meant two and a half months of 10-hour days and seven-day weeks.

Management may also think it can apply a bandaid at PDCs during a strike more easily than at plants. Most of these facilities employ between 50 and 150 workers, a fraction of the workforce of a typical manufacturing plant. It might seem easier to train white-collar workers to be pickers and forklift drivers than to train them for all the jobs required to run an assembly line.

But workers in parts distribution centers are skeptical. “I think it’s silly that they’re even attempting to do our job,” said Roberto Rivera, who works at a Ford HVC in Rancho Cucamonga, California, and is on the executive board of his unit in UAW Local 509. “They don’t have the manpower and they won’t be nearly as efficient.”

Bagwell also brings up safety concerns. “Our trainer is our health and safety rep, a UAW member who will be out on the picket line with us,” he said. “Management is not getting the same training to drive a hi-lo that we are.”

UAW members at parts distribution centers are preparing for a strike like their fellow union members in the plants. Members of Local 174 have been participating in the contract campaign launched by the UAW international, signing pledge cards and holding “Red T-Shirt Wednesdays.” They held a barbecue and practice picket, which drew a large proportion of the facility, and all the members have already signed up for picket shifts.

ENDING TIERS

Bagwell, who was previously the chairman of Local 174 and is also an elected convention delegate, says he’s as excited as he’s ever been about the direction of the union. He was a member of the reform movement New Directions in the 1980s. He says President Shawn Fain, backed by today’s reform caucus Unite All Workers for Democracy (UAWD), is carrying on the legacy of New Directions.

Newer workers in his facility have been running up to him in excitement over Fain’s Facebook Live appearances, especially the union demand to eliminate tiers.

“This is a big deal for many workers at the facility,” Bagwell said. “More than half of the workers are second tier. It can take up to 15 years for some of them to get full pay.”

At Rivera’s Ford facility in California, turnout was high for a recent practice picket. There too, Fain’s video appearances are popular, Rivera said: “I’m seeing an international union that I’ve never seen before, that’s very vocal with members, practicing transparency and upfront honesty. It’s really turning heads.”

In spite of the profits they generate, most parts distribution center workers are paid less than manufacturing workers. GM and Stellantis treat them as lower-tier workers—starting at $17 an hour and topping out at $25 after an eight-year progression, compared to a maximum of $32 for employees in manufacturing plants. (Ford pays PDC and manufacturing workers the same wage rates.)

The UAW has proposed to eliminate these wage tiers for PDC workers, who fall under the CCA division at GM and the MOPAR division at Stellantis, and bring them up to par with other employees. However, according to Fain’s Facebook live video on September 8, GM is proposing to continue “substandard pay” for CCA workers, and offering only a 2 percent wage increase for those at the top of the scale. Stellantis is also proposing to continue lower pay for MOPAR.

COMMUNITY SUPPORT NEEDED

Kimberly Ross works as a picker at the Stellantis MOPAR Parts Distribution Center in Tappan, New York, which handles a variety of parts and accessories, from brake pads to spare tire covers. She said the facility suffers from understaffing, faulty machinery, and a shortage of supplies like gloves.

“The workload is easier than building cars,” she said. “They used to call it a retirement home. But now we can’t get people in there because of the wages.”

Ross expressed concern that a potential picket line in Tappan could be thin, given the small number of workers at her facility. If they walk out, 24-hour picket lines will have only two to three workers on each shift.

Community support on the picket line could help. Because parts distribution centers are located all over the country, many of them near major urban centers, substantial numbers of non-UAW members can show up in solidarity.

Regardless, parts distribution center workers are prepared, should they be called into action. “Me and a lot of workers out there are ready for this strike,” said Rivera. “We are going to go out as long as it takes to get our demands taken seriously.”

“We’re in a moment in time that will be written in the history books,” said Matt Frantzen of Belvidere. “People are ready to be a part of it.”

Luis Feliz Leon and Jane Slaughter contributed reporting for this article.

Corrections: The Ford HVC plant is in Rancho Cucamonga, not Pico Rivera, California, and the word "aftermarket" has been clarified to "after-sales" throughout this article.

You must log in or register to post a comment.