Blocked Nippon Deal Is Lesson on Tariffs: Workers Need a Say

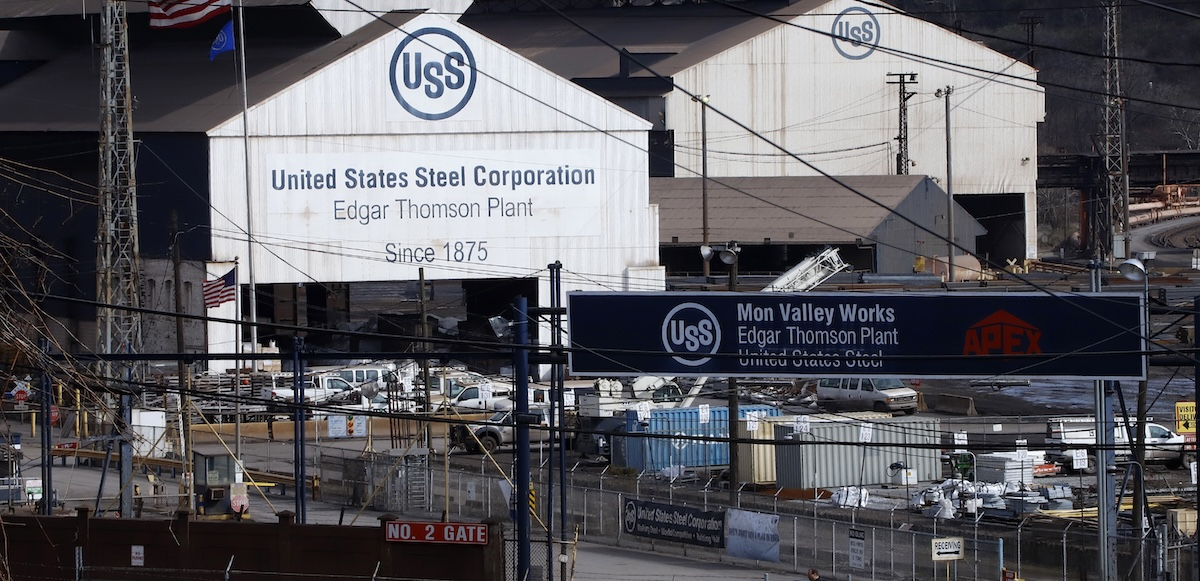

The Edgar Thompson steel mill in Braddock, Pennsylvania, is one of three Mon Valley facilities that U.S. Steel threatened to close if it didn't get taken over by Nippon Steel. The company tried to scare workers into supporting the deal. Still, most were skeptical and the union fully opposed it. Photo: Gene J. Puskar/AP

The business press howled in January when outgoing President Joe Biden blocked Japanese steel giant Nippon from buying U.S. Steel.

The Steelworkers (USW) had strongly opposed the deal. But Nippon’s promises to invest, and U.S. Steel’s threats to close plants, led some members and local union officials to support it.

As a result, the press portrayed the disagreement as “union bosses” versus the rank and file. In fact, most workers were skeptical and the union had good reasons to oppose the takeover.

The Trump administration has imposed 25 percent tariffs on imported steel and aluminum, to start March 4. But the attempted purchase by Nippon is a good example of how tariffs won’t protect industrial jobs unless workers have a say in the process.

COMPANY PR PUSH

U.S. Steel and Nippon spent tens of millions promoting the purchase. Nippon proclaimed billions in new investment and a $5,000 bonus to every worker.

“They spent a lot of money to try to brainwash everybody into thinking this is good,” said Don Furko, former president of 1,100-member Local 1557 in Pennsylvania. And U.S. Steel had people “worried about their jobs, and understandably so.”

U.S. Steel threatened that without Nippon, it would have to shutter or reduce production at plants in the Mon Valley, southeast of Pittsburgh: Clairton Coke Works, the Irvin processing plant in West Mifflin, and the Edgar Thompson mill in Braddock.

SUDDENLY BROKE

As opposition to the takeover mounted in the fall, U.S. Steel CEO Dave Burritt wrote to union members: “Nippon’s commitment to invest $2.7 billion in USW-represented facilities is at risk. These commitments would be transformative, but certain politicians (and the USW International) want to take that away. Their actions threaten thousands of blast furnace and supporting jobs.”

“Before, the company was well-positioned and everything was going well,” said Furko, recalling the 2018 and 2022 bargaining rounds. “Now all of a sudden the Mon Valley won’t survive unless Japan takes over? Come on.”

“No, you’re not broke—you show us your finances every time we’re bargaining,” said Justin Ellsworth, a union safety trainer at Clairton.

The union charged that disinvestment in the Mon Valley was a choice U.S. Steel had already made, and it expected Nippon to follow suit. “For Nippon, this has always been about reducing American blast furnace production and opening up American markets for Japanese-produced products,” said USW President Dave McCall on January 10.

Despite its extravagant PR, Nippon would not promise the union anything past the 2026 contract expiration.

CHARM OFFENSIVE

Workers first heard about Nippon’s offer from the news in late 2023, said Furko, who maintains machines at Clairton. Nippon promised to keep the name U.S. Steel and keep the headquarters in Pittsburgh, “and that was the only thing we heard for quite a while.

“And then all of a sudden [the companies’] PR movement started,” he said, “with the billboards and the postcards and the commercials on TV and radio.”

Keli Vereb, a 29-year union activist at Edgar Thompson, received a steady drumbeat of company emails selling the deal: “I probably have 200 pages of emails.” Two billboards appeared near her house.

Steelers football games were punctuated with pro-deal messages. Ads popped up on workers’ phones. Company officials made presentations at the plants.

Then the threats began, said Furko: “As soon as it became clear that there was going to be big resistance towards this merger, Dave Burritt went and made his statement, ‘Well then, we’re going to have to start shutting down facilities in the Mon Valley and moving headquarters south.’”

WHIPLASH

Mon Valley steelworkers have whiplash from U.S. Steel’s shifting plans. In 2019 the company announced with much fanfare that it would make $1.5 billion in improvements at Edgar Thompson, allowing a continuous process from raw materials to rolled steel. A co-generation plant at Clairton would use coke oven gas to generate electricity, reducing emissions.

“Contract language had already been written and signed off on for the jobs that were going to be transferred from Irvin to Edgar Thompson,” said Vereb. Workers broke ground and moved equipment.

But two years later, U.S. Steel quietly halted the project and moved the new equipment south to its non-union Big River “mini-mill” facilities in Arkansas, where electric furnaces recycle scrap steel rather than making it from scratch.

Recycled steel can’t be used for some applications, such as many automotive components. The technology is advancing, though, and U.S. Steel appears to be moving away from making steel and toward recycling it. The company shut down its Fairfield, Alabama, blast furnace in 2015 and idled furnaces at Granite City, Illinois, in 2023, citing environmental concerns. Mini-mills produce less pollution.

SUPPORT LABOR NOTES

BECOME A MONTHLY DONOR

Give $10 a month or more and get our "Fight the Boss, Build the Union" T-shirt.

Union members suspected that Nippon’s real plan, despite its public claims, was to shut down the parts of plants that make steel from scratch, and instead bring steel slabs from overseas to roll out in the U.S., avoiding tariffs. “They don’t need a blast furnace,” Vereb said. “They have 10 in Japan.”

The U.S., on the other hand, has only seven primary mills in operation, with U.S. Steel operating two. The prospect of losing more steelmaking capacity drew government attention. A group of cabinet officials called the Committee on Foreign Investment in the United States (CFIUS) reviewed the deal and asked Nippon for guarantees that it would maintain capacity.

Once steelmaking capacity is lost, it’s hard to bring it back. Primary steel requires coke ovens and blast furnaces. Once coke ovens are shut down, they can’t be started again, Ellsworth explained. When he’s not doing safety training, Ellsworth’s job is patching ovens at Clairton, which are brick without mortar. “It’s the heat that fuses them together,” he said. They can be idled and kept hot, but if they are ever allowed to go cold, “they just crumble like dust.” Blast furnaces need to be kept hot to stay in good working order, too.

“People think security means guns and tanks and stuff,” said Furko. “But that’s not what it means. It means being able to make your own products in your own country.” The supplies for Mon Valley steel are mined by U.S. workers: specialty Appalachian coal and iron ore from mines the company owns in Minnesota.

NIPPON FACED TARIFFS

The Biden administration had already imposed 29 percent tariffs on Nippon. The company was caught selling its steel at artificially low prices (“dumping”) in the U.S. to undercut competition. In November the Commerce Department imposed the tariffs on Nippon’s hot-rolled steel as punishment for dumping in 2022 and 2023—the most recent in a line of decisions against Nippon going back 10 years.

While CFIUS extracted some pledges from Nippon, it wasn’t enough for three of the six cabinet officials involved. So the decision fell to Biden, who blocked the deal. (Donald Trump also opposed it.)

In response, the companies have sued the government and the union. The union moved to dismiss the suit February 5, charging that the companies are trying to stifle its right to free speech.

BIG PAYDAY FOR C-SUITE

While the workers got nothing in writing to back up Nippon’s hard sell, the takeover agreement would have furnished U.S. Steel CEO Burritt with $72 million in cash and equity. Other top executives would have split an $83 million payday. No wonder they were vigorously promoting the deal, with company vice presidents spending up to an hour on the phone with rank-and-file members.

Managers on the floor kept talking up the purchase, and the blizzard of propaganda paid off. “You definitely had bosses who were very for it,” said Ellsworth. “And then you had people on our side who got pulled into that, and then used as spokespeople. I think that was very deliberate.”

Managers circulated in the plant, asking workers to sign a pro-deal petition. They paid workers overtime to attend rallies at Clairton and at company headquarters in Pittsburgh. Still, Furko and Ellsworth noted that most hardhats worn at the rallies were white—these were managers.

Managers also came attired in their fire-resistant suits, which looked to workers like putting on a show. “None of them were getting in their cars with their work sh*t on and driving to Pittsburgh,” Ellsworth said. “That honestly did not go over very well with a lot of us.”

The press repeatedly quoted three local union officials who supported the deal. Local 2227 Vice President Jack Maskil told the Financial Times, “Here in the Mon Valley, we’re a ticking time bomb if this deal doesn’t go through.” Union workers who were opposed, like Ellsworth and Vereb, said they were interviewed but rarely quoted.

SMALLER FISH

Workers also feared that Nippon ownership would dim the union’s prospects.

“Right now, the union is a very large part of the U.S. Steel workforce, so we have leverage,” said Ellsworth, although he observed that the non-union Arkansas facilities undermine that power somewhat.

But Nippon is the fourth-largest steel manufacturer in the world, while U.S. Steel is a quarter its size by production. “We’re a much smaller fish in a much bigger pond,” he said. “They could easily starve us out.”

Another concern is pensions. U.S. Steel owns a large pension fund that covers workers hired before 2004. Most workers hired after that are covered under a multi-employer fund run by the union, Ellsworth said. But union members worried that, with creative corporate structuring, Nippon could raid the fund.

After Biden blocked the merger, the news confirmed the union’s worst fears about Nippon. Bloomberg reported that in its talks with CFIUS, Nippon had negotiated a “force majeure” clause cancelling any investment commitments in the event of strikes and lockouts. This was designed to tie the union’s hands—but also, workers pointed out, the company could lock them out purely to void any written pledges.

OTHER SUITORS

Other companies have tried to buy U.S. Steel. The Steelworkers supported an earlier offer from Cleveland Cliffs, based on the idea that Cliffs would have an incentive to keep the Mon Valley plants running and up to date—it needs the added capacity. The Steelworkers already represent workers at most of Cliffs’ steelmaking facilities.

Now Cleveland Cliffs is reportedly working on an offer with Nucor, the U.S.’s largest steel manufacturer. Cliffs would buy U.S. Steel, partly with Nucor money, and then turn the Arkansas complex over to Nucor.

But that tie-up might raise antitrust concerns. “You would have Cliffs controlling the overwhelming majority of automotive-grade steel being made,” said Furko.

Steelworkers have learned to live with uncertainty. In 1973, when Ellsworth’s father-in-law first hired in, an old-timer asked him, “Son, why’d you get a job here? We ain’t going to be around in another six months.”

“It’s always been a thing,” Ellsworth said. “There is definitely a mentality here of just keep swiping in until they tell us not to.”

BEWARE COMPANY APPS

Employers are increasingly using phone apps to reach workers with the bosses’ point of view. During the contract campaign at Boeing last year, the company advertised its “2024 Negotiations” app with banners in the plant, implying that it was a joint project of the company and the Machinists union. In fact, the app pumped out pro-company propaganda and the union had nothing to do with it.

Amazon uses its A to Z app to push anti-union messages. The app is required to clock in and out, get info on schedules, request time off, and other job necessities. A worker at Amazon’s Bessemer, Alabama, warehouse told scholar Teke Wiggin, “They were constantly sending us anti-union propaganda like in the middle of the night, super early in the morning, while we were working.”

At U.S. Steel, the Steelworkers union in past years got the news of the annual bonus from the company and announced it to members. But after the company instituted an app to deliver that news, everyone downloaded it, said Don Furko, who works at Clairton Coke Works in Pennsylvania.

Once everyone had the app, the company used it during its propaganda blitz to try to sell workers on a takeover by Nippon Steel.

You must log in or register to post a comment.